Notes to the Income Statement

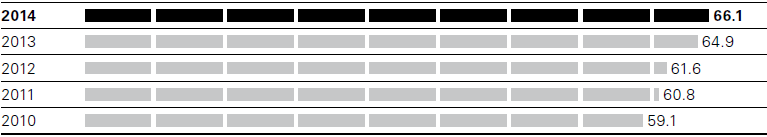

Gross profit margin (in %)

Gross profit margin increased to 66,1%

The gross profit in fiscal year 2014, at EUR 1.699 million, was 8% above the prior-year figure (2013: EUR 1.580 million). The gross profit margin therefore increased by 120 basis points to 66,1% (2013: 64,9%). This performance was particularly due to the above-average growth in the Group’s own retail business and lower discounts in this channel.

Expansion of the Group’s own retail business resulting in higher selling expenses

Selling and marketing expenses in fiscal year 2014 totaled EUR 995 million, up 12% year on year (2013: EUR 892 million). Relative to sales, selling and marketing expenses increased from 36,7% to 38,7%. Particularly due to the global expansion of the Group’s own retail business, selling expenses increased in the reporting year by 10% compared to the prior year. This includes additional expenses for the net increase of 31 locations, which were opened or taken over in the course of the global expansion of this sales channel in fiscal year 2014. The increase in selling and marketing expenses by 19% year on year mainly reflects intensified brand communication activities in the areas of advertising, digital and retail marketing. In relation to sales, selling and marketing expenses increased compared to the prior year to 6,3% (2013: 5,7%). Additional lease expenses associated with the commissioning of the new flat-packed goods distribution center in Germany contributed to a 14% increase in logistics expenses compared with the prior year. At 2,6% of sales, they were slightly higher than the prior year’s level (2013: 2,5%). Bad debt allowances and bad debts were again immaterial in the reporting period 2014 on account of continued strict receivables management and the declining proportion of the wholesale business in consolidated sales. Notes to the consolidated financial statements, Note 3

Slight reduction in administration expenses in relation to sales

Administration expenses in fiscal year 2014 totaled EUR 236 million, up 3% year on year (2013: EUR 229 million). As a percentage of sales, however, they fell slightly to 9,2% (2013: 9,4%). General administration expenses increased by 3% to EUR 175 million (2013: EUR 170 million). Relative to sales, research and development costs incurred during the creation of fashion collections remained at the prior-year level of 2,4%, while increasing in absolute terms by 5% year on year to EUR 62 million (2013: EUR 59 million). Notes to the consolidated financial statements, Note 4

The net expense arising from other operating expenses and income of EUR 19 million (2013: net expense of EUR 3 million) resulted from special items which were essentially related to the early dissolution of the agreement with a trade agent in the Middle East and the closure of the production site in Cleveland, Ohio, which is scheduled for the first half of 2015. As a result, income generated in the first quarter of fiscal year 2014 in connection with the sale of a showroom in France was completely offset. Notes to the consolidated financial statements, Note 5

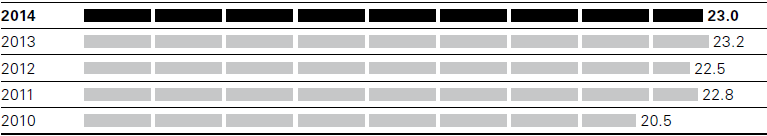

Adjusted EBITDA margin (in %)

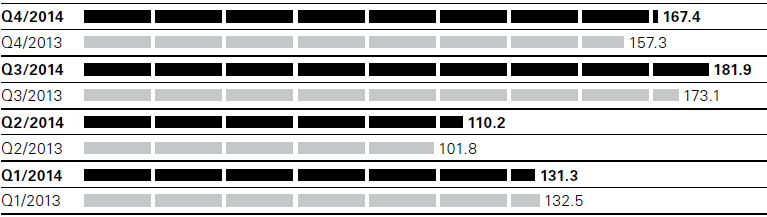

EBITDA before special items by quarter (in EUR million)

5% increase in EBITDA before special items

The key internal performance indicator EBITDA before special items increased year on year by 5% to EUR 591 million (2013: EUR 565 million). At 23,0%, the adjusted EBITDA margin was 20 basis points below the prior-year figure (2013: 23,2%). The increase in selling and distribution expenses was not fully compensated by the increase in the gross profit margin. Due to an increase in the ratio of property, plant and equipment to total assets as a result of investments in the Group’s own retail business, amortization and depreciation came to EUR 123 million, up 17% over the prior year (2013: EUR 105 million). EBIT came to EUR 449 million at the end of fiscal year 2014, down 2% year on year (2013: EUR 456 million).

Improvement in financial result

The financial result, measured as the net expense after aggregating the interest result and other financial items, improved in fiscal year 2014 by 49% to EUR 12 million (2013: EUR 23 million). On account of the lower amount of debt and a lower interest level, the net interest expense decreased significantly by 69% to EUR 5 million (2013: EUR 14 million). Other financial items came to a net expense of EUR 7 million and, mainly due to an improved trend in exchange rates, were 14% below the prior year’s level (2013: net expense of EUR 8 million). Notes to the consolidated financial statements, Note 6

Consolidated net income slightly above prior-year level

At EUR 437 million, earnings before taxes were up 1% year on year (2013: EUR 433 million). At 23%, the Group’s income tax rate was on the same level as in the prior year (2013: 23%). The shares of earnings of companies of the HUGO BOSS Group in Germany and abroad had a neutral impact on the Group’s tax rate in fiscal year 2014 due to regional differences in growth rates. Net income totaled EUR 437 million in the past fiscal year, up slightly year on year (2013: EUR 433 million). The net income attributable to equity holders of the parent company also increased by 1% to EUR 333 million (2013: EUR 329 million). Net income attributable to non-controlling interests came to EUR 1 million and mainly relates to the 40% investment held by the Rainbow Group in the “joint venture” entities in China, which were taken over in their entirety by HUGO BOSS at the end of June (2013: EUR 4 million).

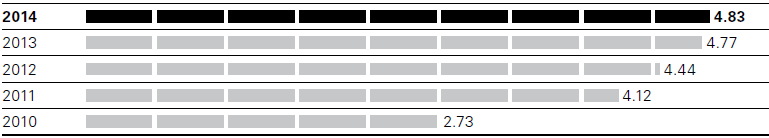

Earnings per share (in EUR)

Earnings per share improved year on year by 1% to 4,83 EUR (2013: 4,77 EUR).