Financial management and financing principles

The most important goal of financial management at HUGO BOSS is to secure the Group’s financial strength in the long term through sufficient liquidity reserves.

Central bundling of global financial management

Group-wide financial management comprises corporate finance, cash and liquidity management, and the management of market price risks and default risks. It is centrally organized in the corporate treasury department. Global financial management is based on Group-wide principles and guidelines. At the level of the subsidiaries, the finance managers are responsible for compliance with treasury guidelines.

The external financing volume of the HUGO BOSS Group is essentially drawn through HUGO BOSS International B.V. This allows economies of scale to be leveraged and the cost of capital to be optimized. Only in individual cases do HUGO BOSS companies directly obtain debt capital, for instance, if it is economically advantageous to use local credit and capital markets. If the Group companies directly enter into external loan transactions, HUGO BOSS AG issues guarantees or letters of comfort in exceptional cases.

The corporate treasury department optimizes and centralizes payment flows and secures Group-wide liquidity in its cash and liquidity management. The cash inflow from the operating activities of each Group company is the Group’s most important source of liquidity.

Using efficient cash management systems, liquidity surpluses of individual Group companies are used to cover other companies’ financial requirements (cash pooling). This intercompany financial balancing system reduces external financial requirements and net interest expenses.

Debt funding and financing structure

Market capacity, cost of financing, investor diversification, flexibility, covenants and terms to maturity are taken into account when selecting financial instruments. Notes to the consolidated financial statements, Notes 27 and 30

Syndicated loan secures long-term financial flexibility

The Group secured its financial flexibility in the long term by refinancing the syndicated credit facility that expired in May 2013. A syndicate of banks led by DZ Bank, Landesbank Baden-Württemberg and Unicredit AG granted the syndicated loan with a volume of EUR 450 million and a term of five years. This comprises a fixed tranche amounting to EUR 100 million and a revolving tranche of EUR 350 million. As of the reporting date, only the fixed tranche had been used.

In its capacity as “in-house bank”, HUGO BOSS International B.V. provides these funds to Group companies with increased financing needs in the form of intercompany loans. These loans are issued in the local currency of each respective distribution company and, for the most part, take the form of an overdraft facility. In addition, subbranches of the revolving tranche permit amounts to be borrowed in foreign currencies. The Group has additional liquidity secured in the form of bilateral lines of credit with a total volume of EUR 111 million, of which EUR 67 million had been drawn as of December 31, 2014. Apart from the undrawn amounts from the lines of credit amounting to EUR 394 million, the Group has access to liquidity funds of EUR 129 million as of the reporting date, of which EUR 10 million is kept in time deposits with a term of up to three months.

Financing conditions

The syndicated loan agreement contains a standard covenant requiring the maintenance of total leverage, defined as the ratio of net financial liabilities to EBITDA before special items. Notes to the consolidated financial statements, Note 27

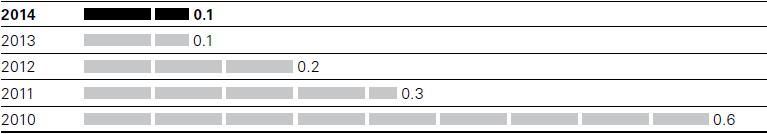

Total leverage as of December 311

1 Net financial liabilities/EBITDA before special items.

Total leverage at prior-year level

As in prior fiscal years, HUGO BOSS was substantially lower than the maximum permissible value as of December 31, 2014. At 0.1, the total leverage ratio was at the prior year’s level as of the reporting date.

The financial liabilities of the HUGO BOSS Group are mostly subject to variable interest rates and have short fixed-interest periods for the most part. Of the amount of financial liabilities amounting to EUR 133 million subject to variable interest rates, a volume of approximately EUR 111 million was hedged against an increase in interest rates using payer swaps as of December 31, 2014. There is no exposure to interest rate risks from the fixed-interest loans. Notes to the consolidated financial statements, Note 27

Land charges in connection with land and buildings amount to EUR 42 million (2013: EUR 45 million).

Off-balance sheet financial instruments

Financing is supplemented by operating lease agreements not reported in the statement of financial position relating to the Group’s own retail locations as well as logistics and administration properties. Notes to the consolidated financial statements, Note 33