Free float increases

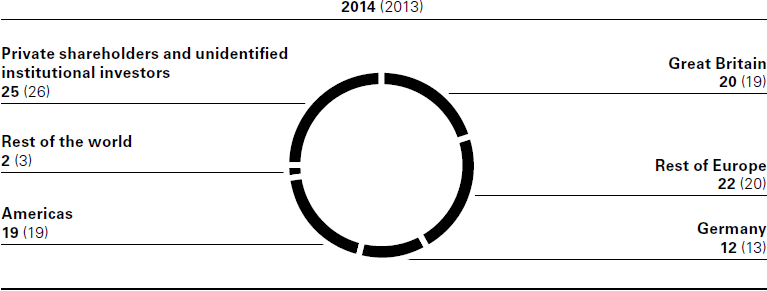

In the course of the year, Red & Black Lux S.à r.l., in which private equity company Permira holds a majority interest, sold just under 17 million HUGO BOSS shares. As a result, Permira’s share in HUGO BOSS dropped from 56% at the end of 2013 to 32% at the end of 2014. Consequently, the free float widened to 66% (December 31, 2013: 42%). HUGO BOSS AG continues to hold own shares amounting to 2% of the share capital (December 31, 2013: 2%).

Shareholder structure as of December 31 (in % of share capital)

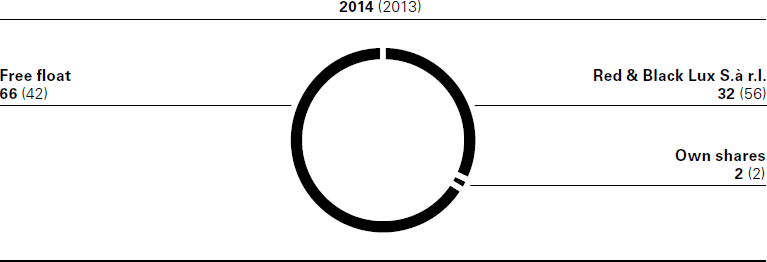

Internationally balanced shareholder structure

The ownership structure of the shares in free float was analyzed in 2014 with a view to addressing the institutional investors investing in HUGO BOSS in a more targeted manner. The result shows that HUGO BOSS’ investor base has become even more international. Indeed, the portion of shares held by institutional investors in Great Britain increased to 20% (2013: 19%). In addition, the weighting of other European countries in the shareholder structure rose to 22% (2013: 20%). However, the portion of shares held by German investors decreased slightly to 12% (2013: 13%). The portion held by American investors remained stable at 19% (2013: 19%). Private shareholders enlisted in the share register and institutional investors on which the Group does not have any further details make up 25% of the free float (2013: 26%).

Regional split of investor base as of December 31 (in % of free float)